Blog

Blog

Decoding the Latest Inflation Data: What It Means for Loans and Rates

Hey there, fellow borrowers and investors! Said Hamood here, your friendly neighborhood loan officer in the beautiful state of Washington. Today, I want to break down the recent inflation data that just dropped on us and what it means for all things loans and interest rates.

Inflation in Check: Just as the Fed Ordered

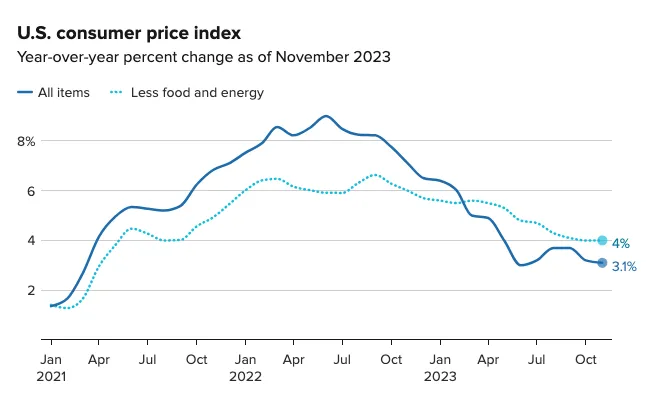

So, the latest scoop is that the consumer price index (CPI) in November increased by a modest 0.1%, bringing the yearly rate to 3.1%. Now, if you're wondering, "Is that good or bad?" - well, it's pretty much right where the Federal Reserve had its eyes set. The market was expecting no gain and a yearly rate of 3.1%, and that's precisely what we got.

Core CPI: The Real MVP

Now, let's talk about the real star of the show – the core CPI. Stripping out the volatile food and energy prices, the core CPI rose by 0.3% on the month and 4% from a year ago. Why does this matter? Because it's holding steady and coming down just as expected, indicating some positive trends in the broader economy.

What Caught My Eye as a Loan Officer:

As someone knee-deep in the loan game, I've got my radar finely tuned to anything that could sway interest rates. Here's my take:

Energy Prices Doing the Heavy Lifting: A 2.3% decrease in energy prices helped keep inflation in check. Gasoline fell by 6%, and fuel oil was down 2.7%. Good news for our wallets and the overall inflation picture.

Shelter Prices Holding Strong: Shelter prices, a significant part of the CPI, increased by 0.4% on the month and were up 6.5% on a 12-month basis. That's something to keep an eye on, especially if you're in the real estate game.

Fed Meeting on the Horizon: With the Fed meeting on the horizon, the report suggests a pause in rate hikes. The expectation is that rate cuts might be on the table in 2024. This aligns with what the market is anticipating.

My Take as a Loan Officer in Washington State:

In our neck of the woods, this data suggests a potential stabilizing of interest rates, which is generally good news for those in the market for a loan. However, we're not out of the woods yet. With the Fed meeting just around the corner, it's essential to keep a watchful eye on the signals they send about future rate movements.

Closing Thoughts: So, there you have it – a breakdown of the recent inflation data from your friendly neighborhood loan officer. As always, stay informed, stay engaged, and feel free to drop your thoughts in the comments. Let's navigate these financial waters together.

Cheers to financial wisdom and savvy borrowing!

Connect with me on social media for more updates and discussions.

Said Hamood

Mortgage Broker

NMLS#1827048

David Gonzales

Mortgage Broker

NMLS#2488523

Mood Mortgage Powered by Barrett Financial Group, LLC | NMLS #1827048 | Barrett Financial Group, L.L.C. | NMLS #181106 | 275 E Rivulon Blvd, Suite 200, Gilbert, AZ 85297 | TX view complaint policy at

www.barrettfinancial.com/texas-complaint

| WA MB-181106 | Equal Housing Opportunity | This is not a commitment to lend. *All loans are subject to credit approval. |

mlsconsumeraccess.org/EntityDetails.aspx/COMPANY/181106